Washington offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Washington Clean Energy Fund

Renewable Energy Incentives

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Washington State Capitol

416 Sid Snyder Ave SW,

Olympia, WA 98504

Visitor Services: (360) 902-8880

Email: [email protected]

Events & Activities: (360) 902-8881

Email: [email protected]

Hours: M-F 7:30am-5:00pm

Hours: Weekends & Holidays 11:00am-4:00pm

Puget Sound Energy

BOT-01H

P.O. Box 91269

Bellevue, WA 98009-9269

Phone: 1-888-225-5773

Email: [email protected]

Hours: M-F 7:30am-6:30pm

Washington State Energy Division

Olympia Office

011 Plum Street SE

P.O. Box 42525

Olympia, WA 98504-2525

(360) 725-4000

Hours: M-F 8:00am-5:00pm

Seattle/Tacoma Weather Bureau

7600 Sand Point Way NE

Seattle, WA 98115-6349

Phone: (206) 526-6087

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Solar Sales Tax Exemption | 50% | Systems between 101 and 500 kW |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Washington Utilities and Transportation Commission

Community Solar

Clean Energy Transformation Act

Net Metering Guide

Building Electrification Program

Solar Deployment Grant Program

Rural Clean Energy

Power Outage Map

Washington State Department of Commerce – Energy Office

Olympia Office

1011 Plum Street SE

P.O. Box 42525

Olympia, WA 98504-2525

(360) 725-4000

Monday – Friday

8 AM – 5 PM

Seattle Field Office

2001 6th Avenue

Suite #2600

Seattle, WA 98121

(206) 256-6100

Monday – Friday

8 AM – 5 PM

Spokane Field Office

601 E Riverside Ave

Suite #470

Spokane, WA 99202-5903

(360) 725-4003

Monday – Friday

8 AM – 5 PM

Residential solar systems are an excellent investment in Washington State, especially if you mitigate the cost using Washington solar incentives.

What Solar Credits Are Available in Washington?

Federal and state renewable energy programs, along with local energy prices make it a great opportunity to not only help reduce fossil fuel consumption, but also potentially eliminate (or at minimum, significantly lower your) electricity bills.6

This comprehensive guide explains how Washington solar incentives work for homeowners, to reduce the cost of home solar energy installation, as well as the many rebates, programs and initiatives that can help reduce your energy footprint.

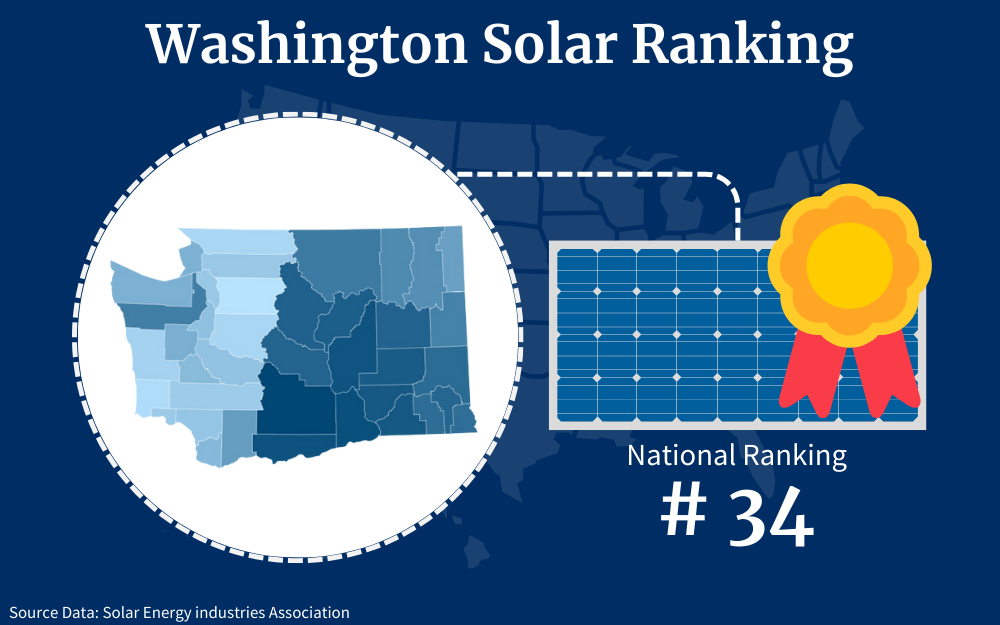

The Solar Energy Industries Association ranks Washington’s current solar market 34th in the country.

The number is a bit below par at the moment, but this does not mean solar energy in the state isn’t worth investing in; quite the opposite, in fact, because it gives the state to create more Washington solar incentives that will convince homeowners to take advantage of solar energy.

As more and more people explore switching to clean energy options both for cost savings and the environment, the federal and state governments also work to make them more accessible and affordable to consumers through different incentive programs.

One such program is the solar tax credit.

You may wonder, what is the federal solar tax credit and how does it work?

EERE Programs Explained: Residential Solar Tax Credits

In general, when you claim a tax credit from the IRS it means you are claiming a reduction in the income tax for that year.

As of 2023, the federal tax credit as it applies to residential solar systems is at 30%. This means that you can claim 30% of the total cost of your solar system from your taxes owed from that year.

So as a hypothetical example, if you pay $33,000 for the total cost of a solar system, you should be able to claim a $9,900 credit that will function as a reduction in income tax owed. It is important to make sure that all the costs you list for your solar system are eligible, but in general, the qualifications are loose.

So the tax credit is a strong incentive. It was devised to reward individual residents for investing in solar energy.

You might be wondering ‘What are the individual limits on the federal solar tax credit?’ The answer is that there is no limit on the dollar amount that you can claim from the IRS.1

Note that the tax credit is considered ‘non-refundable’ which basically means that it cannot create an obligation for the government to pay a taxpayer who, with the solar credit, would have ‘negative taxes.’ It only functions to reduce taxes owed. So the tax credit will not affect everyone the same.

Federal Solar Tax Credit Application

The phrase federal solar tax credit actually refers to the Residential Clean Energy credit (as it applies to solar systems).

In addition to eligibility for the federal solar tax credit, Washington State residents are also eligible for various state-level solar benefits.

Here we will discuss those most relevant to individual residential solar PV projects, as opposed to larger community-targeted ones.9

Sales Tax Exemption

One of Washington State’s solar benefits is the sales tax exemption: (ESS Senate Bill 5116). This bill sees that from July 2019 until 2030, qualified equipment will be exempt from state and local sales and use taxes.

This complete exemption applies only to equipment for systems less than 100 kilowatts. There is a 50% exemption from there up to 500 kilowatts, although different rules apply.

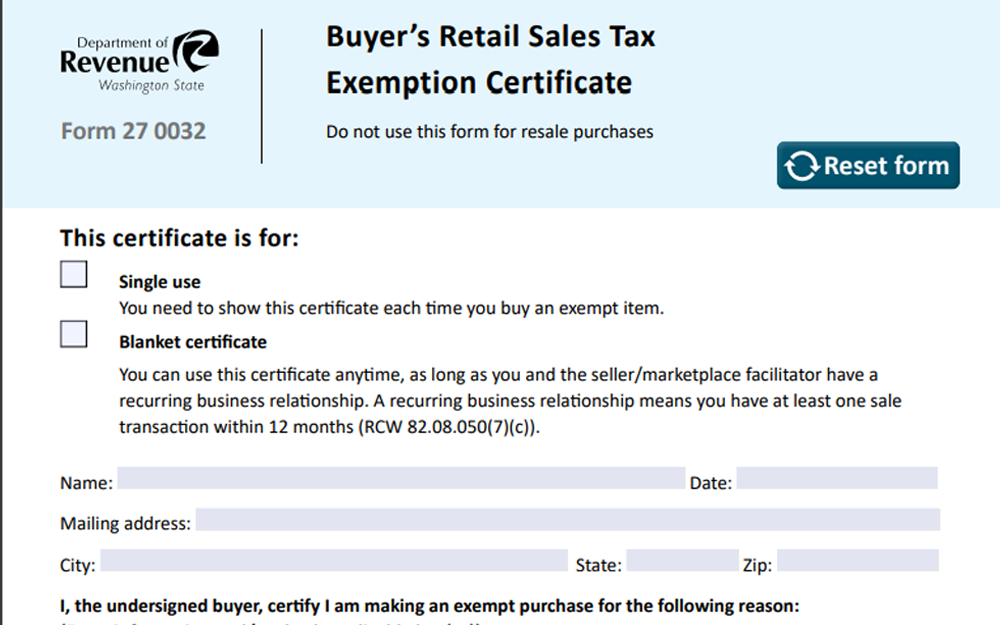

Your vendor will be able to help you with the information, although you must complete the Buyer’s Retail Sales Tax Exemption Certificate.2

Green and Resilient Retrofit Program (GRRP)

This program was designed to provide financing services and grant funding to energy-efficiency projects. The program works with the US Department of Housing and Urban Development (HUD) so the eligible solar projects are supposed to be related to their multifamily assisted housing properties.15

Weatherization Assistance Program (WAP)

This program comes from the US Department Of Energy (DOE) but is administered at state and local levels.16 It is designed to incentivize weatherization of residences, which basically means making them more energy efficient by, for example, things like improving the insulation capacities of windows.

It is designed for households that make more than double the poverty income guidelines or those receiving Supplemental Securities or Aid to Families with Dependent Children.

Tribal Energy Program

The Indian Energy Policy office has a program whereby they offer funding for new solar projects in tribal communities.

They offer various grants through the Tribal Solar Accelerator Fund (TSAF). They provide financing to eligible borrowers including tribes or legal entities that meet certain DOE criteria.

The loans come from regulated commercial banks or other financial institutions.13 It could also come from another tribe that has been granted appropriate clearance by the DOE for negotiating loans.

These types of loans can fund an extremely broad range of potential projects.

Renewable Energy System Incentive Program

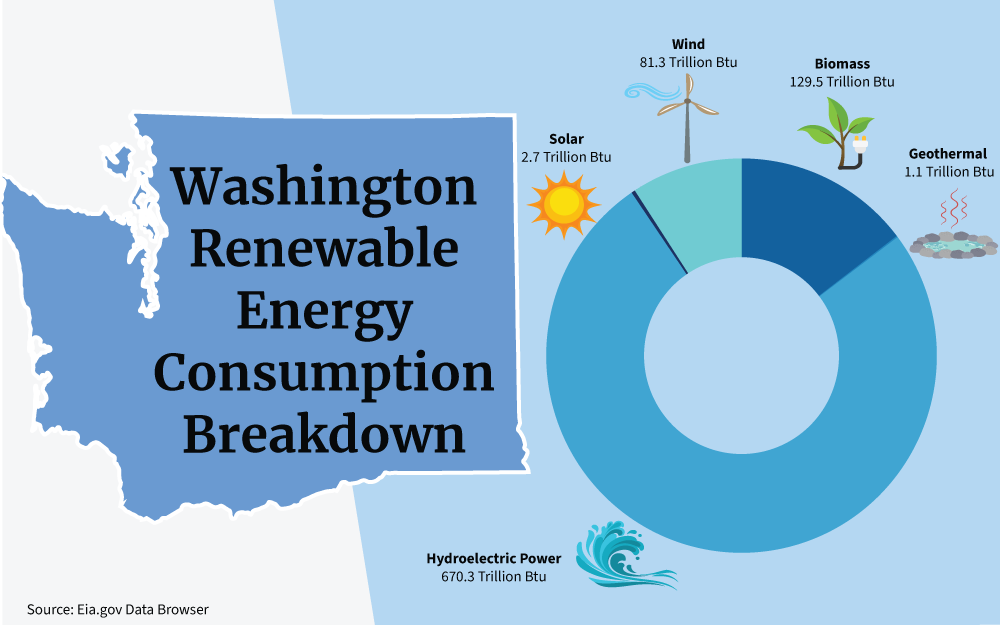

According to the U.S. Energy Information Administration, Washington State is the second top producer of utility-scale electricity from renewable sources across the country. However, most of it comes from hydropower; only a small amount comes from solar.

Washington State started an incentive program in 2017 in partnership with the Washington State University energy program.17 This program basically provides payments as an incentive for renewable energy systems owned by both individual residential and commercial utility customers and community solar customers.

Community solar is a type of project whereby individuals or businesses, non-profits, etc. buy into a solar project, like an investment, and receive payments or credits for the solar panel electricity produced. These are ideal for those who cannot afford their own system or cannot host one on their property.

However, as of now the Washington State incentive program is fully subscribed and full. If it receives additional funding from the state legislature it might reopen, but that has not been scheduled.

How To Apply for Solar Credits and Rebates in Washington

Each of the Washington solar incentives requires you to register, and each process can be slightly different.

The following information explains how you can take advantage of these options to lower the cost of a home solar energy system.

Federal Solar Tax Credit

The solar tax credit aka the Residential Clean Energy credit, should be included with your tax return on the year during which your solar system installation was completed. It is filed simply with IRS form 5695.

When it comes to filing taxes, if you occupy the residence with other persons (with whom you are not filing a joint return, and who is not your spouse), then each resident should fill out and submit their own 5695 Form.

There are many other guidelines on the submission of this form on the IRS website, but your best resource will probably be your accountant or tax specialist.4

Here are the steps for the application process:

Step 1. Get the form. This credit is applied for using IRS form 5695.7

Step 2. Additional documentation reporting expenses and compliance with municipal codes could be required.8

Step 3. Often your solar installer will take care of the bulk of the documentation for you. However, a tax specialist should be consulted to ensure capturing the maximum credit.

Net Metering

Washington State law requires utilities to make net metering available to eligible solar customers.

The best way to apply for net metering is by contacting your utility company directly, either before or during the purchase and installation process on your system. They may have an application portal directly on their website or you may need to contact them directly to begin the process.

Sales Tax

The Washington State solar sales tax exemption is regulated through Bill 5116.

The way to obtain the exemption is that you must fill out a Sales Tax Exemption Certificate to the seller of your eligible expenses.14 They will verify the certificate and then discount the sales tax.

The Tribal Solar Accelerator Fund

To apply for the tribal solar accelerator fund, you can apply either to an existing solicitation or with your own proposal. To apply for existing solicitations visit the department webpage.12

To submit your own proposal, eligible parties can reach out to the Department of Energy by emailing [email protected] or by phone at 202-586-1262.

Applications are evaluated of course on the grounds of technical eligibility, but also on readiness and prospect of repayment. DOE then does its research approvals, negotiations, and deal structuring to begin documenting and closing the deal for funding.

How Much Does It Cost for Solar Power Systems?

The cost of your solar system will obviously depend on factors such as the system’s size, capacity, the installer you choose, and any special considerations, with size probably being the biggest determinant.

They range between about 5.8 to 13.4 watts.

Washington’s current renewable energy breakdown includes mostly solar, but by increasing home installations, the state can reduce it’s emissions.

If the average size home solar system is 9 kilowatts, then the average system price would be about $27,000. This is the upfront cost before factoring in any federal tax credit or Washington solar incentives.

Remember, the federal tax credit can save you 30% of the total cost, and Washington State systems are income tax exempt.

Then factor in other programs like net metering, and most homeowners make their money back between 6-9 years. That is an excellent investment because the average lifespan of solar panels is over 15 years.

Buying Solar Panels Washington State

There are basically three different ways of purchasing a solar system.

The first is simply to buy it outright, with cash. This is the preferred way and the cheapest in the long term.

This type of ownership is definitely eligible for the federal tax credit.

The second way is through financing.

Similar to how you would use financing to purchase a home or a car (paying in installments over time with interest) you can purchase solar panels from a reputable dealer. This method of ownership is also eligible for the solar tax credit.

The third way of acquiring solar panels is through what’s known as a PPA agreement.

By the terms of this agreement, a solar installer installs their panels on your property with a meter. You get to use the electricity but they charge you usually for every unit of electricity generated.

One of the benefits of this arrangement is that it is comparatively low upfront cost. However, it is not eligible for the federal tax credit, and will usually turn out to be significantly more expensive, especially for longer arrangements.3

Solar Panel Calculator: Requirements and Cost Savings

Smart solar savings means understanding the costs involved. The price of PV modules depends on the size of your system.

If the average price of a residential system is around 9 kilowatts, then the average price should be around $27,000, and you can expect to make back the cost of your initial investment in only around 7 years. Consult a solar savings calculator to get a better understanding of the numbers involved.3

Solar Panels Cost

One way to reduce the initial cost of solar panels while forgoing a financing or PPA option is to install them yourself. This eliminates the need to pay a company for solar system installation.

However, it comes with some disadvantages.

If you are not a professional, this will likely take a lot of time. And there is a risk of making a mistake.

With a project this significant and potentially valuable, it is probably worth paying to have it done to professional standards.

Down the line you don’t need to be dealing with unnecessary problems with solar energy or problems of solar panels like broken solar panels, especially considering that most reputable installers offer strong warranties and that 30% of the installation cost is eligible for the federal tax credit.

Net Metering Explained

For an on-grid or grid-tied residential PV system, one of the steps in the installation will be to have a member of the local utility company come out and attach a meter to the solar electric system. This is so they can measure the amount of electricity going from the utility to the house and from the house to the utility.

Logically, your solar system only functions during the day and can generate a great amount of power because of sunlight.

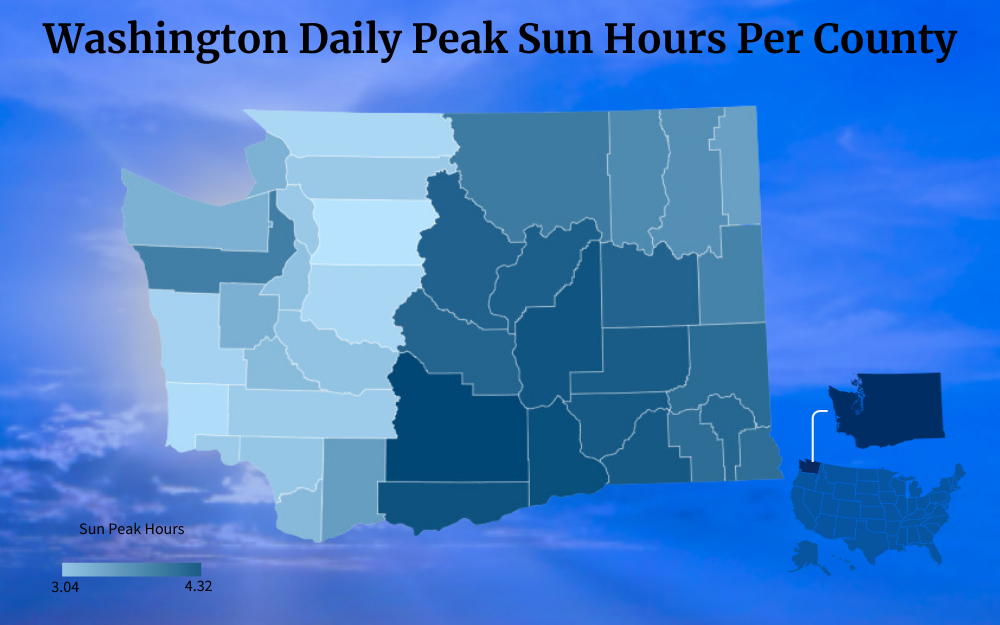

This is why as someone who is exploring going solar, you should also know the peak sun hours in your area, or in simple terms, how much sunshine your location is getting on average.

However, at night, it doesn’t produce. This means that you may have more electricity than you need during the day, and not enough at night.

You could use batteries to store the electricity on-site, but the more common way is net metering. You use electricity from the utility as normal during the nighttime, accumulating your monthly energy bill.

However during the day, all of your excesses gets sent back to the utility bill, and the utility credits the value of the energy you send them by reducing your monthly energy bill.

In this way, net metering can completely eliminate the electricity bill for a residence, depending of course on the exact amount of electricity sent and received.

Can You Make Money From Net Metering?

Net metering allows a solar customer to drastically reduce and or eliminate their electrical bill. In this way, it functions almost like to solar tax credit in that it pays as a reduction in a bill you would otherwise owe.

However, the difference is that, whereas the cost of a solar system is an option, for most homeowners in North America, paying a monthly electric bill is a necessity, and therefore, the money saved by net metering can be seen as more of a profit.

Net Metering in Washington State

In Washington State, net metering is regulated with the law (RCW 80.60.030),10 This ensures that local utilities offer residents the opportunity to offset their electrical consumption bills with the generation of solar energy.

It also applies like the federal tax credit to other types of ‘renewable’ energy such as wind and thermal.

Your local utility provider will likely have an application for this process on their website.

The process is relatively simple. The utility will install a meter at your house to measure electricity to and from the grid, and credit only the balance to the customer.

This balance is calculated at the end of the year on March 31, when outstanding credits expire. They roll over monthly until then.4

What About Non-Rooftop Solar Panels?

You may be asking, “What if the solar panels are not on my roof?”

If the solar panels home system are not on your roof you should have no problem taking advantage of the incentives outlined here. You can install solar system wherever the PV cells may receive sunlight and allow integration with the rest of the system.

Most people choose the roof because it does not require any additional space taken up outside, and looks aesthetically pleasing. Nothing in the federal tax credit, sales tax exemption, or net metering policy requires a solar system to be roof-mounted.

How To Choose Solar Panels in WA

Choosing a solar panel provider in Washington State can be a relatively straightforward process. Obviously, a major factor is going to be price.

You don’t want to be overpaying for your system, and you don’t want to be paying for things you don’t need. However, because the system will probably last you upwards of 15 years, and because 30% of the total cost is tax deductible, it is not the type of purchase on which you want to sacrifice quality.

It is worth paying extra for strong warranties, great customer service, and a recycling program.

Remember, the system will likely pay for itself in around 7 years, and after that will be making you money you would otherwise pay in electricity bills. It is certainly an expense worth having done right.

Changing Regulations

One factor you should consider when choosing solar providers and installers to work with is the impact of solar energy on environment. Different suppliers and installers have different sustainability of supply, maintenance, and disposal or recycling systems.

One of the bad things about solar energy is that, while the panels can produce energy without burning fossil fuels, which is hypothetically beneficial to the environment, there is a significant concern about the amount and severity of environmental damage associated with the beginning and end of the panels’ lives.

They are made of highly toxic raw metals, and where are solar panels made and disposed of often have little to no environmental or personal safety standards, and can leach these metals into the environment after disposal.11

It is very likely that the coming years will witness specific governance of proper sourcing and disposal of these panels.

What this means for the average consumer is that it would be beneficial to work with companies that already have ethical supply chains and or recycling programs. As regulations increase, companies without these advantages will likely have to change their businesses and increase costs, which will be bad news for their customers.

So inquire about sourcing and recycling options when choosing an installer.

In 2017, the Washington State Legislature actually passed a bill that required panel manufacturers to offer recycling methods to all customers purchasing panels after July of that year. And they stipulated it was to be free of charge.

Now, the project is only set to become effective starting July 1, 2025, so until then, it is recommended that customers contact local product stewardship organizations, or email the state recycling service.5

Is Washington State Good for Solar Panels?

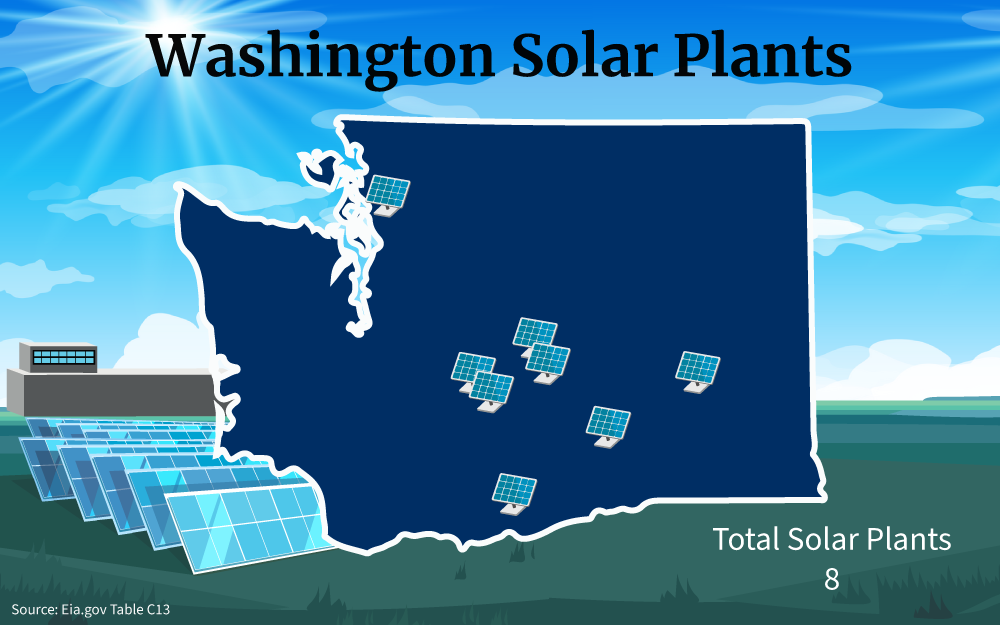

Currently, there are 8 solar farms across Washington that help generate green electricity for the region. That may be a small number for now, but it’s only going up from here.

Washington State is an excellent place for residential solar systems. Washington has state-level programs like sales tax exemption, along with relatively high energy prices and a good choice of solar providers.

Residents will usually end up saving money with solar in the long run.

The federal tax credit reduces almost a third of the initial cost, and then net metering means that you will save money every month on your electricity bill for the entire lifetime of your solar system. Because of how long solar panels last, this means you will almost certainly be up in the long run.

So most Washington systems pay for themselves and then some.

Residential solar systems are an excellent choice for residents who want to reduce their electricity costs, and Washington solar incentives like the federal tax credit and state-level tax exemption coupled with net metering and the net income tax means that your solar system will likely generate significant profit throughout its lifetime.

Frequently Asked Questions About Washington Solar Incentives

Is Installing Solar Panel System Worth It in Washington State?

Washington State has state-sponsored solar incentive programs like sales tax exemption, high energy costs, and a number of good choices of solar providers; when all these are factored in, it is worth it to have a solar panel installation in Washington State. In addition, as the state and nation move more towards renewable energy, and the price of fossil fuels increases, it is likely that the benefits of being energy-independent and producing your own solar power will increase in ways difficult to predict.

How Does The Federal Solar Tax Credit Work If I Don't Owe Taxes?

If you have no income tax obligation for the year, or if your eligible solar credit claim would be greater than your tax obligation for the year, your credits will roll over to the next year. Unfortunately, for the unemployed or people like retirees, it might be more difficult to cash in on the maximum potential value of credits available from a solar system.

Can I Still Get the Federal Solar Tax Incentive If My System Is Ground-Mounted?

Definitely! Whether your system is ground-mounted or roof-mounted, you are still eligible to get the federal solar tax incentive.

References

1Rosen, A. (2023, August 1). Solar Tax Credit: What It Is and How It Works In 2023. NerdWallet. Retrieved August 26, 2023, from <https://www.nerdwallet.com/article/taxes/solar-tax-credit>

2Berdikeeva, S. (2023, June 13). Solar Panels in Washington: Do Incentives Make Them Worth It? CNET. Retrieved August 31, 2023, from <https://www.cnet.com/home/energy-and-utilities/washington-solar-panels/>

3Freitas, T. (2022, August 24). Washington Solar Panels Pricing and Incentives. SaveOnEnergy. Retrieved August 31, 2023, from <https://www.saveonenergy.com/solar-energy/washington/>

4Solar Washington. (2023). Solar Incentives, Tax Credits, Net Metering & More. Solar Washington. Retrieved August 31, 2023, from <https://www.solarwa.org/solar_incentives>

5Danks, T. (2018, December 31). What to Do When Your Solar Panels Expire. SolarTech. Retrieved August 26, 2023, from <https://solartechonline.com/blog/solar-panels-expire/>

6Solar Energy Technologies Office. (2023). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

7U.S. Internal Revenue Service. (2022, December 6). Residential Energy Credits [PDF File]. IRS. Retrieved August 31, 2023, from <https://www.irs.gov/pub/irs-prior/f5695--2022.pdf>

8U.S. Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022). IRS. Retrieved August 31, 2023, from <https://www.irs.gov/instructions/i5695>

9Washington State. (2023, January 24). Solar Deployment Grant Program. Washington State Department of Commerce. Retrieved August 31, 2023, from <https://www.commerce.wa.gov/growing-the-economy/energy/clean-energy-fund/clean-energy-fund-solar-program/>

10Washington Utilities and Transportation Commission. (2022). Net Metering. UTC. Retrieved August 31, 2023, from <https://www.utc.wa.gov/regulated-industries/utilities/energy/net-metering>

11United States Environmental Protection Agency. (2023, June 20). Solar Panel Recycling. EPA. Retrieved August 31, 2023, from <https://www.epa.gov/hw/solar-panel-recycling>

12U.S. Department of Energy. (2022, September 30). Federal Loan Guarantees for Tribal Energy Development Projects. Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/lpo/articles/tribal-energy-loan-guarantee-program-solicitation-current>

13U.S. Department of Energy. (2023). Tribal Energy Financing. Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/lpo/tribal-energy-financing#solicitation>

14Washington State Department of Revenue. (2023, July 18). Buyer’s Retail Sales Tax Exemption Certificate. Washington State Department of Revenue. Retrieved September 14, 2023, from <https://dor.wa.gov/sites/default/files/2022-02/27-0032.pdf?uid=6418826f1cea0>

15U.S. Department of Housing and Urban Development. (2023). FY 2023 Green and Resilient Retrofit Program (GRRP) Comprehensive. HUD. Retrieved September 15, 2023, from <https://www.hud.gov/program_offices/spm/gmomgmt/grantsinfo/fundingopps/fy2023_grrp_comprehensive>

16US Department of Energy. (2023). Weatherization Assistance Program. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/scep/wap/weatherization-assistance-program>

17Washington State University. (2023). Renewable Energy System Incentive Program. WSU Energy Program. Retrieved September 15, 2023, from <https://www.energy.wsu.edu/RenewableEnergy/RenewableEnergySystemIncentiveProgram.aspx>

18Solar Panels on Roof Photo by Cindy Shebley / Attribution 2.0 Generic (CC BY 2.0) . Cropped, Resized and Changed Format. From Flickr <https://www.flickr.com/photos/cindyshebley/38406703841/>